The agreement includes:

The agreement includes:

– Tariff elimination for a wide range of U.S. food exports – pork, bison, dairy, fruits, nuts, soybean oil, processed foods and streamlined sanitary certificate requirements for pork and dairy for easier exports.

– A reinstatement and expansion of the 2020 lobster tariff agreement will make it easier to import lobster into EU-27.

– A commitment from the European Union to reduce regulatory burdens on U.S. food exporters, especially small and medium-sized businesses. In response to U.S. concerns, the EU will adopt more flexible approaches in implementing the Carbon Border Adjustment Mechanism (CBAM), expanding on the recent de minimis exception. How flexible is the larger question, it will also strive to ensure that sustainability laws—such as the Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD)—do not hinder transatlantic trade. This includes efforts to simplify administrative procedures and reconsider liability and climate obligations for non-EU companies.

The biggest winners are U.S. food producers, particularly those in dairy, meat, seafood, and specialty crop sectors.

The EU’s pledge to eliminate tariffs and streamline import procedures will make it easier for small and medium-sized American exporters to reach European consumers shortly. European buyers and retailers may benefit from a more diverse and competitive supply of food products at the expense of the EU’s food export revenues, high food quality controls, and environmental guidelines such as deforestation.

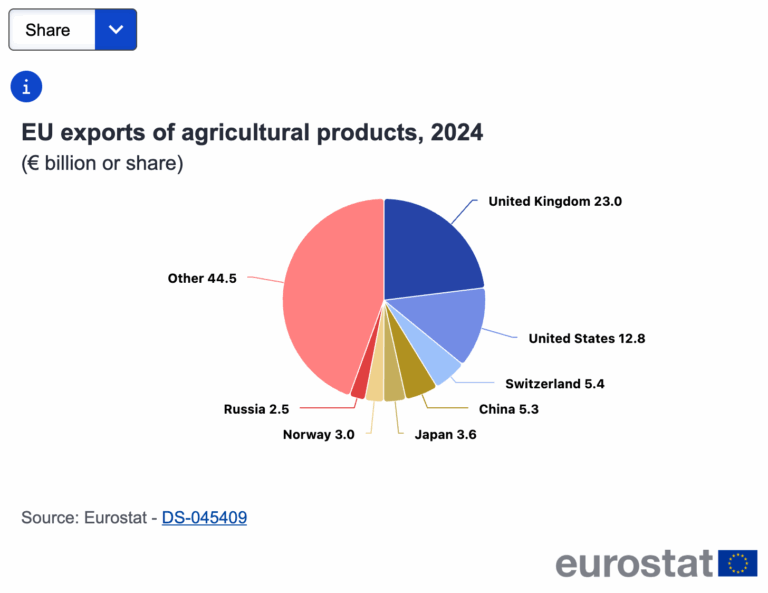

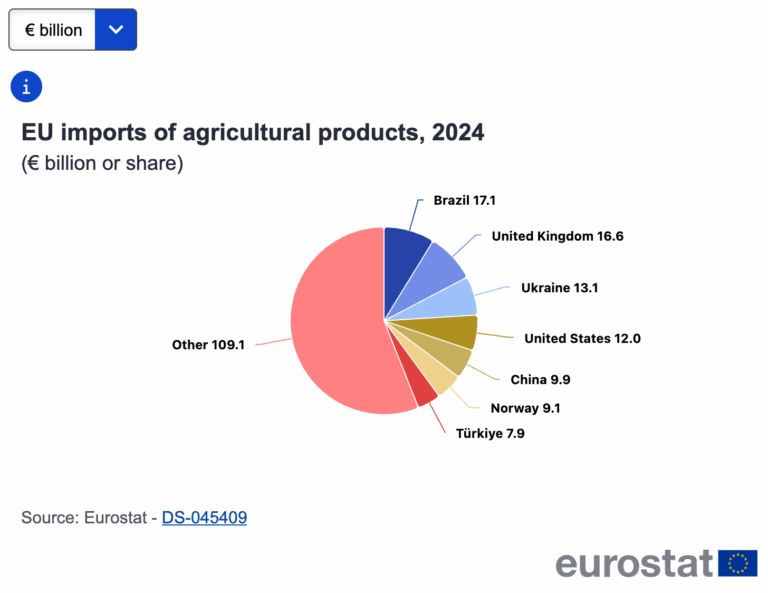

In 2024, EU exports of agricultural products accounted for 9.1% of the total EU trade in goods while imports accounted for 8.0%.

The long-term effects on the agri-food sector, especially producers of wines and wine-based products, cereals, animal products, olive oil and olives, coffee, and cocoa, are likely to be economically damaging. The EU accounts for approximately 67% of global olive oil production. About 4 million hectares, primarily in Mediterranean EU countries, are dedicated to olive cultivation, featuring traditional, intensive, and super-intensive groves. Spain exports about €6 billion of olive oil annually, with €1 billion going to the U.S. Overall, olive oil makes up 12% of Spanish agri-food exports, and the U.S. market accounts for 2%.

Rafael Pico, deputy director of the Spanish Association of the Olive Oil Export Industry and Trade (Asoliva), stated that this agreement constitutes a “competitive loss” for European nations compared to other leading producers. He cautioned that if Spanish officials do not also seek an olive oil exemption, Spain— the world’s largest olive oil producer— would fall behind Turkey and Morocco, which still contend with a ten percent baseline tariff.

Implementation begins September 1, 2025, with legislative and procedural changes expected to roll out in phases.

The EU is set to introduce proposals that align with the agreement, while the U.S. will adjust tariffs and regulatory frameworks accordingly.

This article is part of a series, EU-US Trade Watch, which will delve deeper into the effects of tariffs and new agreements on food products, including wines and wine-based products, cereals, animal products, olive oil and olives, coffee & tea, and cocoa.